Navigating the Fiscal Year: July 2026 – June 2027

Related Articles: Navigating the Fiscal Year: July 2026 – June 2027

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Fiscal Year: July 2026 – June 2027. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Year: July 2026 – June 2027

The fiscal year, a distinct accounting period that often deviates from the standard calendar year, plays a crucial role in various aspects of government, business, and financial management. Understanding the intricacies of this fiscal cycle is essential for informed decision-making and strategic planning. This article delves into the fiscal year commencing July 2026 and ending June 2027, exploring its significance and providing valuable insights for stakeholders across diverse sectors.

The Importance of Fiscal Years

The fiscal year serves as a framework for budgeting, financial reporting, and performance evaluation. It enables organizations to:

- Plan and Allocate Resources: By setting a defined fiscal year, organizations can establish annual budgets, allocate resources strategically, and track progress against predetermined goals.

- Measure Performance: The fiscal year provides a consistent timeframe for evaluating performance, comparing financial results, and identifying areas for improvement.

- Facilitate Financial Transparency: Fiscal years contribute to financial transparency by ensuring that financial reporting occurs on a regular and predictable basis, allowing stakeholders to assess the organization’s financial health.

- Align with Government Cycles: For businesses operating in sectors heavily influenced by government funding or regulations, aligning with the government’s fiscal year is crucial for smooth operations and compliance.

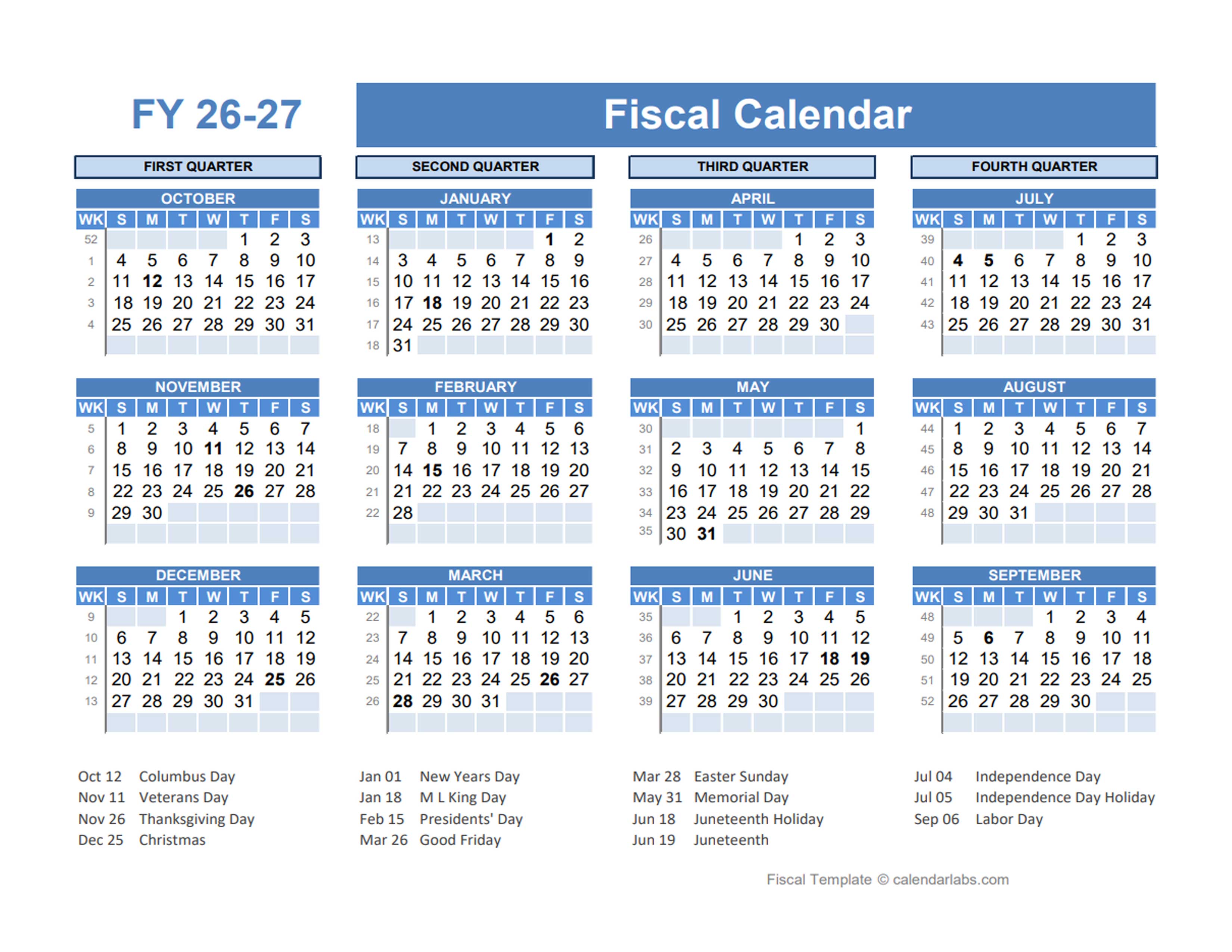

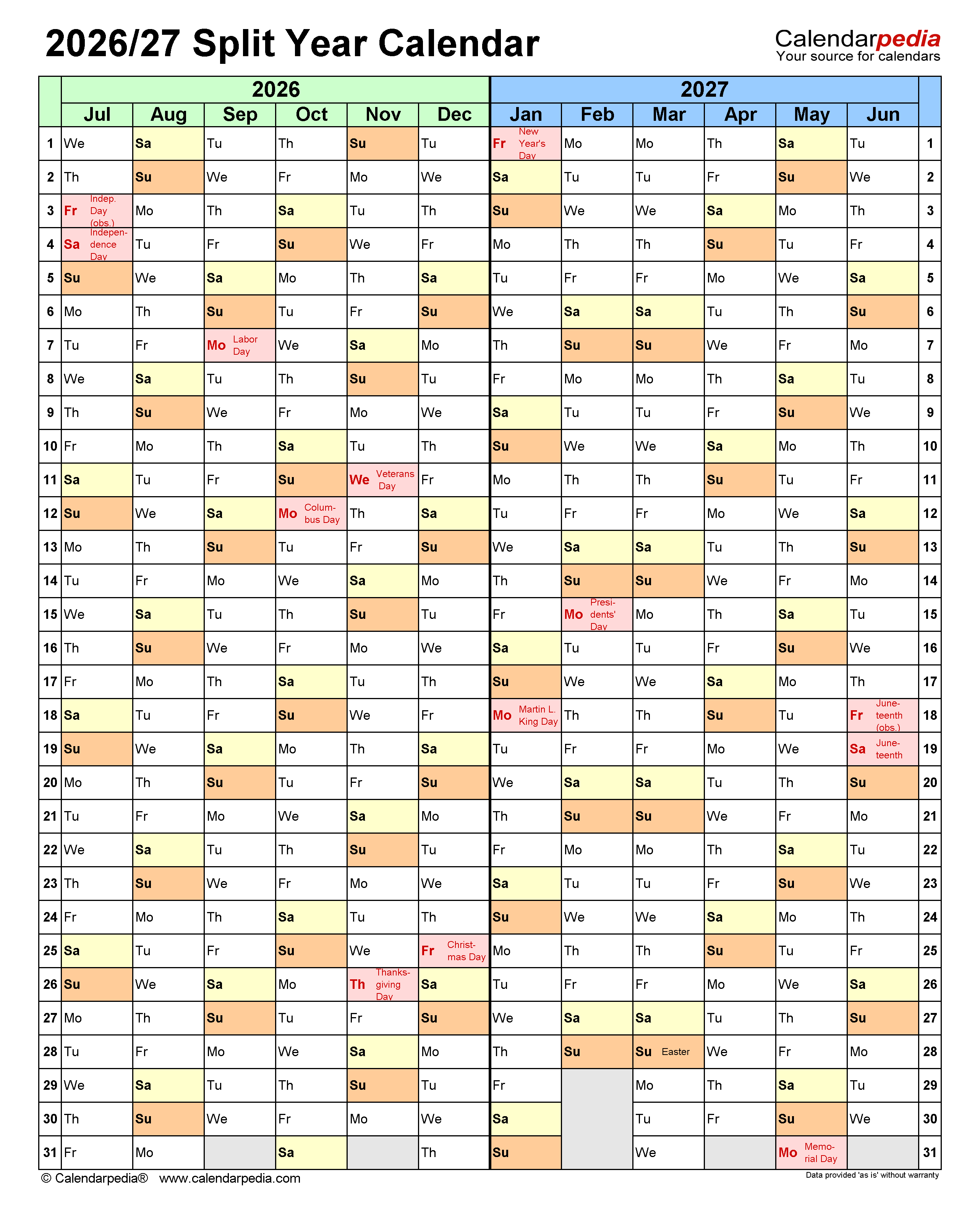

Understanding the July 2026 – June 2027 Fiscal Year

The fiscal year commencing July 2026 and ending June 2027 encompasses a period of twelve months, offering a structured framework for financial planning and management. This fiscal cycle holds significance for a wide range of entities, including:

- Government Agencies: Federal, state, and local governments typically operate on fiscal years, aligning their budget cycles and financial reporting with this timeframe.

- Businesses: Many businesses, particularly those with government contracts or those seeking government funding, adopt fiscal years to align with government requirements and facilitate financial reporting.

- Non-Profit Organizations: Non-profits often operate on fiscal years to streamline grant applications, track funding sources, and ensure financial accountability.

Key Considerations for the July 2026 – June 2027 Fiscal Year

As we approach the July 2026 – June 2027 fiscal year, several key considerations emerge, influencing financial planning and decision-making:

- Economic Outlook: The global economic landscape is constantly evolving, presenting both opportunities and challenges. Understanding the projected economic trends, including inflation, interest rates, and potential growth, is crucial for informed financial planning.

- Policy Changes: Government policies, including tax regulations, spending priorities, and regulatory frameworks, can significantly impact businesses and organizations. Staying abreast of potential policy changes and their implications is essential for adapting financial strategies.

- Technological Advancements: Rapid technological advancements continue to reshape industries and business models. Incorporating technology into financial planning and management can enhance efficiency, improve decision-making, and drive innovation.

- Sustainability Initiatives: Environmental and social considerations are increasingly influencing financial decisions. Organizations are embracing sustainability initiatives, incorporating environmental, social, and governance (ESG) factors into their financial planning and reporting.

FAQs Regarding the July 2026 – June 2027 Fiscal Year

Q: What are the key differences between a calendar year and a fiscal year?

A: A calendar year runs from January 1st to December 31st, while a fiscal year can start and end on any date, often aligned with the organization’s specific needs or government regulations.

Q: How does the fiscal year impact businesses?

A: Businesses operating on a fiscal year align their financial reporting, budgeting, and resource allocation with this timeframe, ensuring consistency and facilitating financial planning.

Q: What are some common challenges associated with fiscal years?

A: Challenges may include aligning with government regulations, adapting to economic fluctuations, and ensuring accurate financial reporting within the defined timeframe.

Q: How can organizations prepare for the July 2026 – June 2027 fiscal year?

A: Organizations can prepare by conducting thorough financial planning, monitoring economic trends, staying informed about policy changes, and incorporating technological advancements.

Tips for Navigating the July 2026 – June 2027 Fiscal Year

- Establish a Clear Budget: Develop a comprehensive budget that reflects the organization’s financial goals, resource allocation, and anticipated expenses.

- Monitor Financial Performance: Regularly track financial performance against budget projections, identifying any deviations and implementing corrective measures.

- Stay Informed about Policy Changes: Continuously monitor government regulations and industry trends, adapting financial strategies as needed.

- Embrace Technology: Leverage technology to enhance financial management, improve efficiency, and gain valuable insights.

- Foster Transparency and Accountability: Maintain transparent financial reporting, ensuring stakeholders have access to accurate and timely information.

Conclusion

The July 2026 – June 2027 fiscal year presents a unique opportunity for organizations to navigate the evolving economic landscape, embrace technological advancements, and prioritize sustainability initiatives. By understanding the importance of fiscal years, proactively addressing key considerations, and utilizing effective planning strategies, organizations can enhance their financial performance, achieve their goals, and contribute to a sustainable future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year: July 2026 – June 2027. We hope you find this article informative and beneficial. See you in our next article!