Navigating the Bi-Weekly Payroll Landscape: A Comprehensive Guide for 2026

Related Articles: Navigating the Bi-Weekly Payroll Landscape: A Comprehensive Guide for 2026

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Bi-Weekly Payroll Landscape: A Comprehensive Guide for 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Bi-Weekly Payroll Landscape: A Comprehensive Guide for 2026

The consistent and accurate disbursement of employee wages is a cornerstone of any successful organization. A well-structured payroll system, particularly one that adheres to a bi-weekly schedule, plays a crucial role in ensuring employee satisfaction, fostering financial stability, and maintaining compliance with labor laws. This comprehensive guide delves into the intricacies of a bi-weekly payroll calendar for 2026, providing insights into its practical applications, potential benefits, and crucial considerations.

Understanding the Bi-Weekly Payroll Cycle

A bi-weekly payroll cycle, as the name suggests, involves the processing and distribution of employee paychecks every two weeks. This system offers several advantages compared to other payment frequencies, particularly for organizations with a large workforce.

Benefits of a Bi-Weekly Payroll System

- Predictability and Consistency: Employees receive their paychecks on a regular schedule, fostering financial stability and predictability in their personal budgeting. This consistent flow of income reduces stress and promotes financial well-being.

- Streamlined Payroll Processing: Bi-weekly cycles simplify payroll management, allowing for efficient processing and distribution of paychecks. This reduces the workload on payroll departments, freeing up resources for other critical tasks.

- Improved Cash Flow Management: For employers, a bi-weekly payroll system provides a more manageable cash flow. Regular payments ensure that financial obligations are met consistently, reducing the risk of financial strain.

- Enhanced Compliance: Bi-weekly payroll cycles often align with statutory requirements, ensuring compliance with labor laws and regulations. This helps avoid potential penalties and legal complications.

Creating a Bi-Weekly Payroll Calendar for 2026

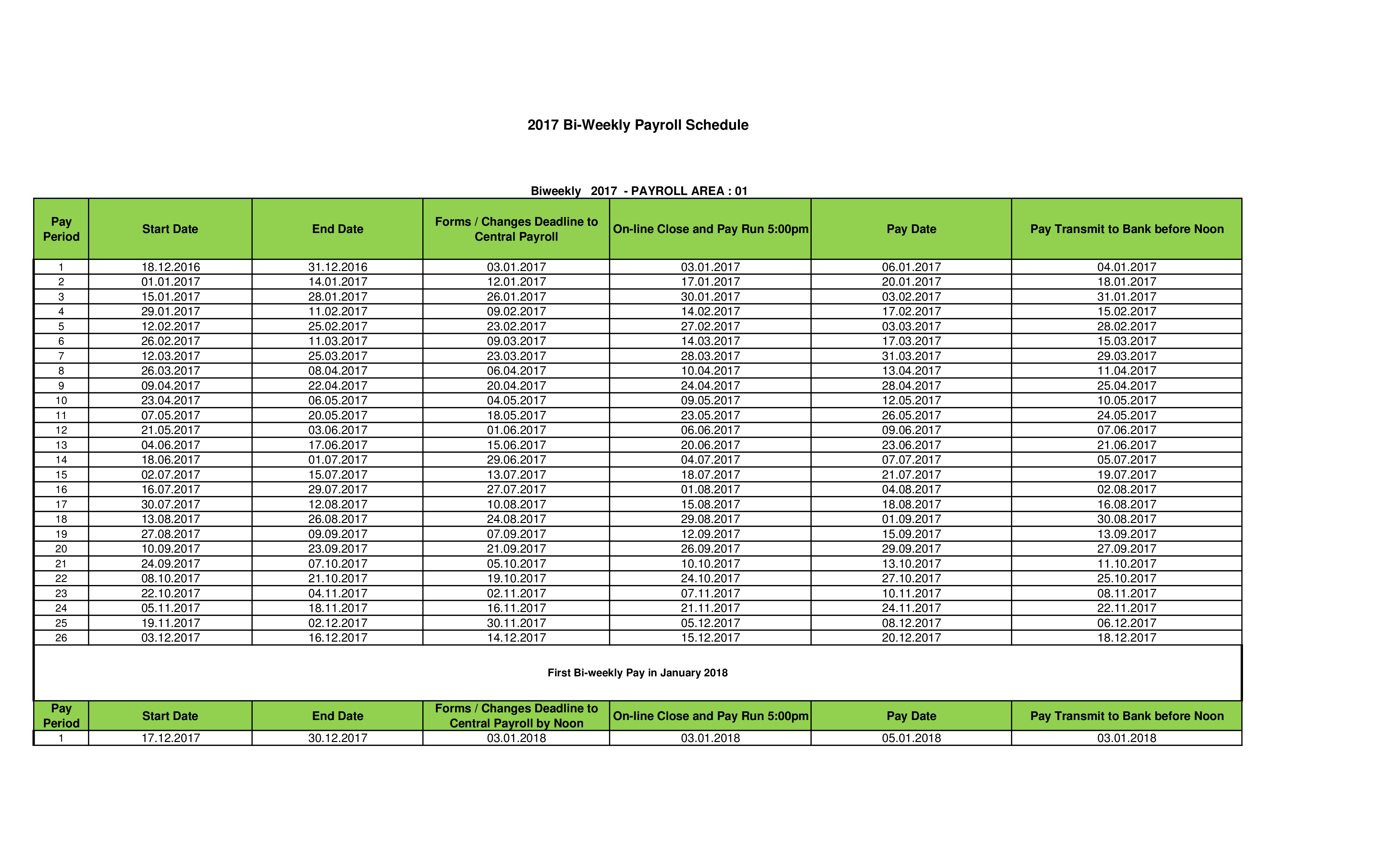

The foundation of a successful bi-weekly payroll system lies in a meticulously crafted calendar. This calendar serves as a roadmap for payroll processing, ensuring that paychecks are distributed on time and in accordance with legal requirements.

Key Steps in Constructing a Bi-Weekly Payroll Calendar:

- Determine the First Pay Date: Establish the initial payday for the year. This date serves as the starting point for the entire calendar.

- Identify Payday Frequency: Confirm that the payroll cycle is bi-weekly, meaning payments occur every two weeks.

- Account for Holidays and Weekends: Factor in statutory holidays and weekends to ensure accurate payday calculations.

- Adjust for Leap Year: In leap years, such as 2026, adjust the calendar accordingly to account for the extra day in February.

- Review and Update: Regularly review the calendar to ensure accuracy and make necessary updates as required.

Practical Considerations for Bi-Weekly Payroll in 2026

- Labor Laws and Regulations: Stay informed about any changes in labor laws and regulations that might impact payroll practices.

- Tax Filing Deadlines: Ensure that payroll taxes are filed in accordance with federal, state, and local deadlines.

- Employee Communication: Clearly communicate the payroll schedule to employees, including any potential variations or adjustments.

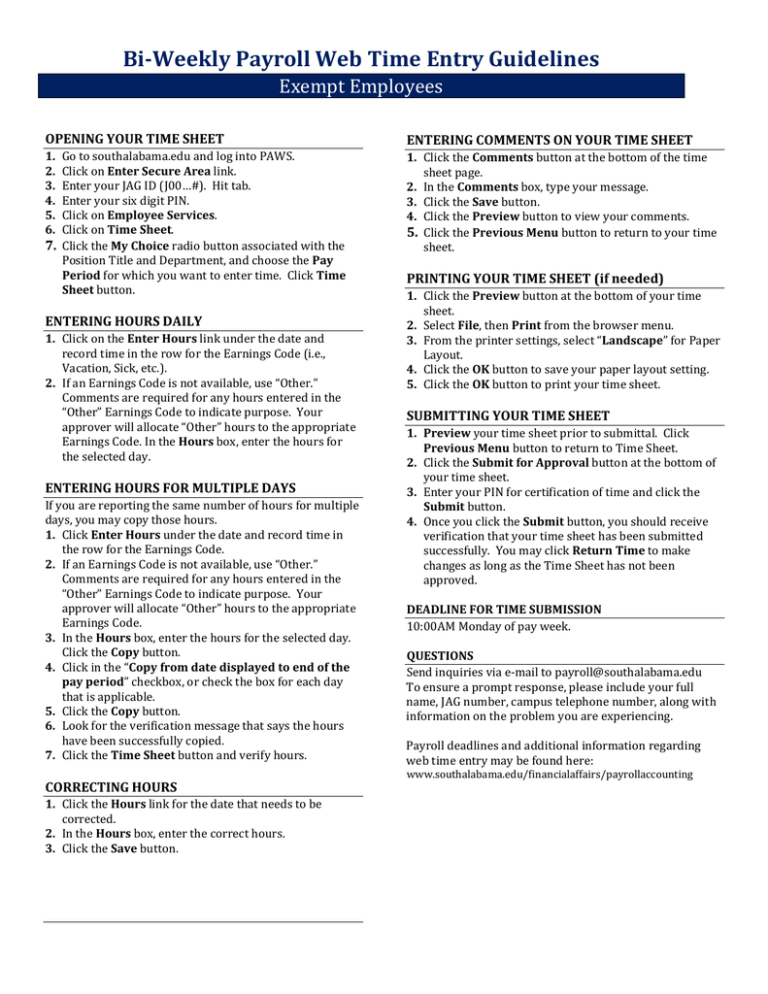

- Timekeeping and Attendance: Implement robust timekeeping and attendance systems to ensure accurate payroll calculations.

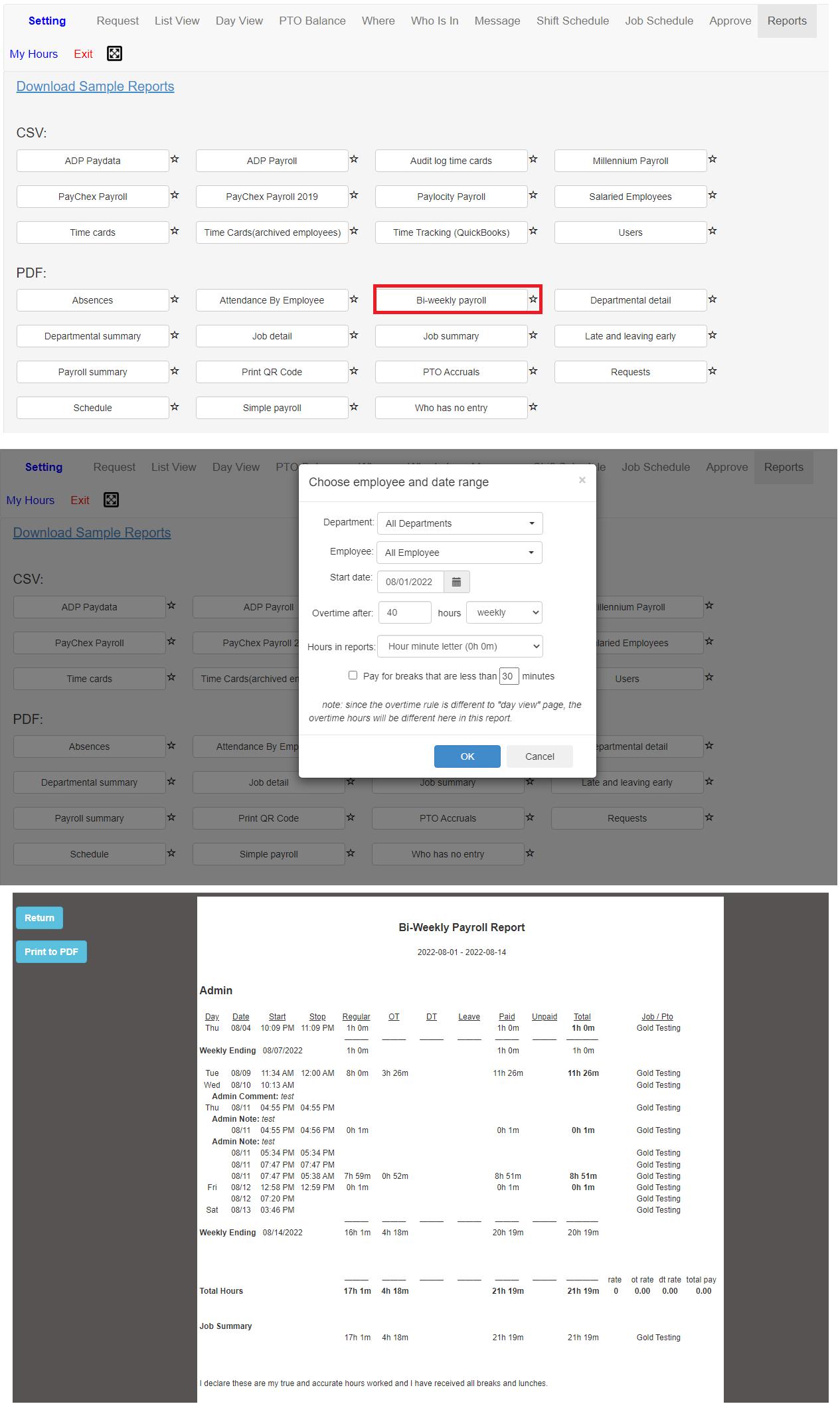

- Automated Payroll Software: Consider utilizing automated payroll software to streamline processes, reduce errors, and enhance efficiency.

FAQs Regarding Bi-Weekly Payroll in 2026

Q: What are the benefits of a bi-weekly payroll system compared to other frequencies?

A: Bi-weekly payroll offers several advantages, including consistent income for employees, streamlined payroll processing for employers, improved cash flow management, and greater compliance with labor laws.

Q: How does a leap year affect the bi-weekly payroll calendar?

A: A leap year adds an extra day to February, requiring a slight adjustment to the payroll calendar to ensure accurate pay dates.

Q: What are some key factors to consider when creating a bi-weekly payroll calendar for 2026?

A: Key factors include determining the first pay date, accounting for holidays and weekends, adjusting for the leap year, and ensuring compliance with relevant labor laws.

Q: How can I ensure that my bi-weekly payroll system remains compliant with evolving regulations?

A: Staying informed about changes in labor laws and regulations, consulting with legal professionals, and utilizing reliable payroll software are crucial steps in maintaining compliance.

Tips for Optimizing Bi-Weekly Payroll in 2026

- Implement Automated Payroll Solutions: Leverage automated payroll software to reduce manual errors, streamline processes, and enhance efficiency.

- Regularly Review and Update the Calendar: Ensure the bi-weekly payroll calendar remains accurate by regularly reviewing and updating it to reflect any changes in holidays, weekends, or legal requirements.

- Foster Transparent Communication with Employees: Clearly communicate the payroll schedule, including any potential variations, to employees.

- Maintain Accurate Timekeeping and Attendance Records: Implement robust timekeeping and attendance systems to ensure accurate payroll calculations.

- Seek Expert Advice: Consult with payroll professionals or legal experts to ensure compliance with all relevant regulations.

Conclusion

A bi-weekly payroll calendar for 2026 provides a structured framework for efficient and accurate wage distribution. By understanding the benefits, implementing best practices, and addressing potential challenges proactively, organizations can optimize their payroll processes, enhance employee satisfaction, and maintain a stable financial foundation. The key lies in a commitment to accuracy, compliance, and effective communication, ensuring that both employees and employers benefit from a well-managed bi-weekly payroll system.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Bi-Weekly Payroll Landscape: A Comprehensive Guide for 2026. We hope you find this article informative and beneficial. See you in our next article!